Unchain Fintech Festival 2025 – When Research Meets Financial Innovation

As technology rapidly reshapes the world of finance, FinNex.ro took the stage at this year’s Unchain Fintech Festival to moderate a high-level discussion on the critical role of academia in building a smarter, more responsible financial ecosystem.

Our panel — Academia & Finance: Bridging Knowledge and Innovation — brought together respected voices in economics, law, AI ethics, and digital education to examine one core idea:

Can research help shape the future of finance, not just analyze it?

🎓 Why Academia Has a Role to Play in Fintech

In an industry obsessed with speed and disruption, academia is often seen as too slow or too abstract. But the panel made it clear:

- Universities can anticipate and respond to market needs like AI and cybersecurity — if they’re proactive

- Academic insight remains essential in framing ethical, legal, and strategic responses to emerging technologies

- Education must evolve from content delivery to applied innovation — building tools, not just theories

There’s no time for passive institutions. The financial sector needs critical thinking, systems design, and research-based foresight — now.

🔗 What FinNex.ro Brings to the Table

At FinNex.ro, we’re not just observing change. We’re building with it.

As an independent academic spin-off, we turn financial research into applied tools and digital infrastructure, such as:

- AI-powered dashboards to measure innovation performance in FinTech startups

- Open Banking datasets linked with behavioral analysis models

- Education scenarios powered by adaptive algorithms

We believe in research with real-world consequences — accessible, ethical, and accountable.

🧠 What We Heard from Our Panelists

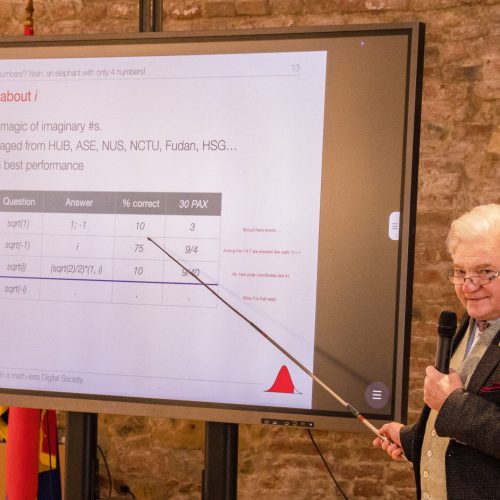

▪ Prof. Ioan Nistor (Chief Economist, Banca Transilvania) stressed the urgency of adaptive academic programs to keep up with digital transformation

▪ Dr. Liana Stanca (UBB) questioned how we maintain human responsibility when AI makes financial decisions

▪ Prof. Cristian Mihes (University of Oradea) highlighted the regulatory risks of AI development in university research labs

▪ Prof. Victoria Bogdan (University of Oradea) explored how AI-enhanced education can close the gap in financial literacy

The session was moderated by Ioana Coita, fintech researcher and founder of FinNex.ro.

🚀 What Comes Next?

The takeaway was simple: Fintech can’t scale responsibly without academic collaboration. And academia can’t stay relevant without practical impact.

FinNex.ro exists precisely at that intersection — a bridge between theory and action.

If you’re building the future of finance and believe research should be part of the process, not an afterthought, let’s talk.

➡️ Explore more at www.FinNex.ro

📬 Subscribe to our newsletter for tools, academic insights, and project updates

🤝 We’re here to make research useful again. Ethically. Strategically. Practically.

FinNex.ro is Romania’s first academic spin-off focused on AI and Finance. We connect researchers, regulators, and fintech leaders to build a financial ecosystem that is both innovative and responsible.